Thinking about your home, your land, or even that small business space in Washoe County often brings up questions about value and what that means for your property. It is that, the Washoe County Assessor’s office plays a pretty important part in our community, looking after how properties are valued for local tax purposes. They help make sure things are fair across the board, which, in a way, supports all the public services we rely on every single day.

This office, you see, is a central point for a whole lot of information about real estate within the county lines. They are the ones who put a figure on how much a piece of property is worth, not for selling it on the open market, but for figuring out what you might owe in property taxes. It’s a job that needs a good deal of careful thought, as these valuations affect everyone who owns a bit of land or a building here, so you know.

Knowing a little bit about what the Washoe County Assessor does can really help you understand your own property’s standing. It’s about more than just numbers on a page; it’s about how our neighborhoods grow, how schools get funded, and how our roads get looked after. So, getting a grasp on their work gives you a clearer picture of how our local system functions, which is that, quite helpful for any property owner.

Table of Contents

- What Does the Washoe County Assessor Do?

- How Does the Washoe County Assessor Figure Property Worth?

- Why Do Property Values Change with the Washoe County Assessor?

- Can You Talk to the Washoe County Assessor About Your Property?

- What Services Does the Washoe County Assessor Offer?

- Making Sense of Your Property Tax Bill - A Look from the Washoe County Assessor's View

- How the Washoe County Assessor Helps Our Community

- Connecting with the Washoe County Assessor

What Does the Washoe County Assessor Do?

The Washoe County Assessor's office holds a pretty important spot in our local government. Their main job is to put a value on all the taxable property within the county. This includes homes, land, and even business properties. They don't set the tax rates, mind you, but their work forms the base upon which those taxes are figured, so it's a big deal.

They are responsible for keeping records of who owns what property, too. This means they keep track of changes in ownership, making sure that when a property changes hands, the records reflect that. It’s a detailed task that helps keep everything straight and proper for everyone involved, you know.

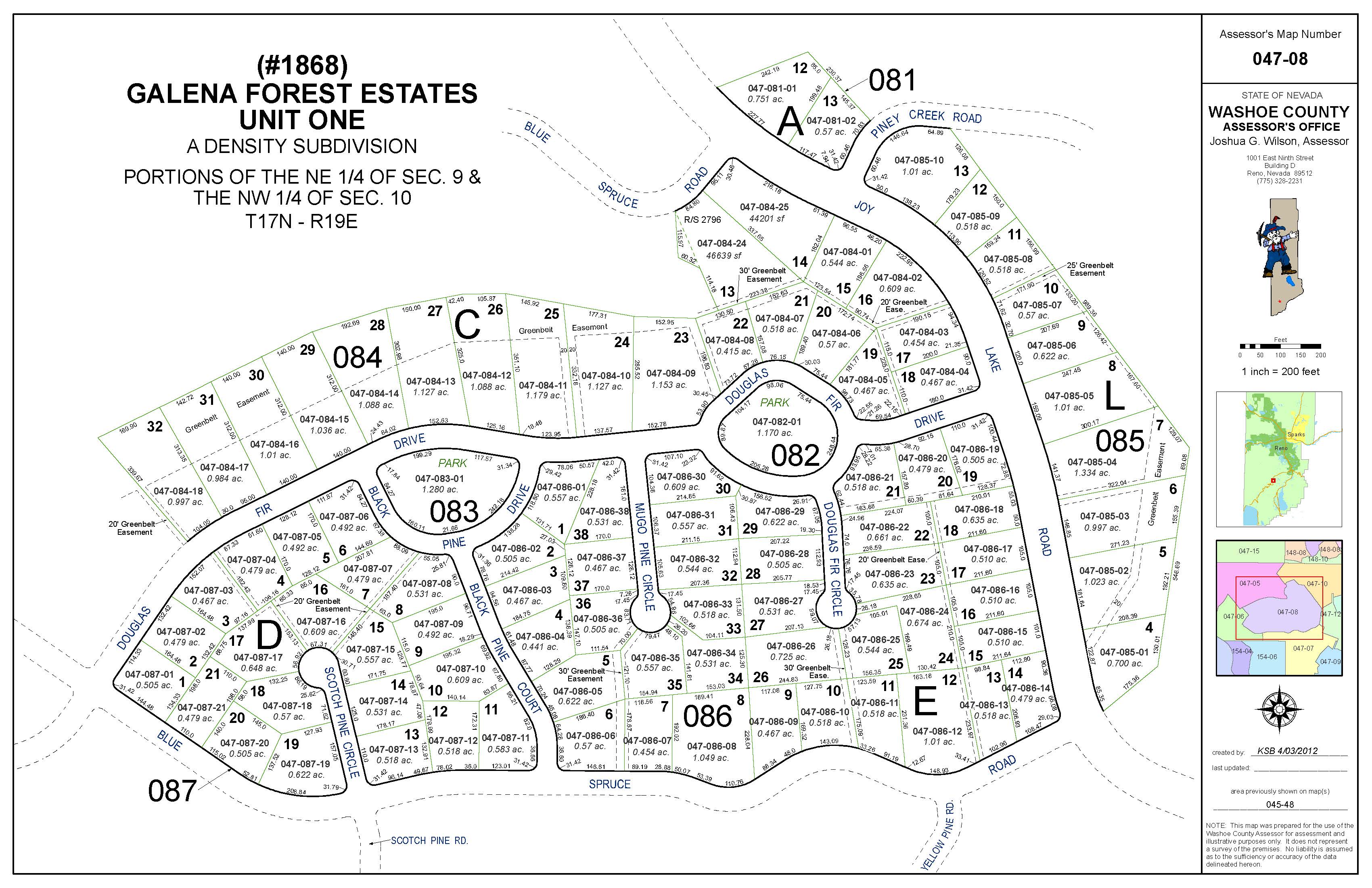

Furthermore, the Washoe County Assessor also maintains a good deal of public information. This includes maps, property descriptions, and even details about building characteristics. It's a resource that's open to the public, helping folks find out more about properties they might be interested in, or just to get a better sense of their own piece of the world, more or less.

Their work supports all the different parts of our community that depend on property tax income. Think about schools, fire departments, libraries, and parks. All these services get their money, in part, from property taxes, and the assessor’s valuations are the starting point for that whole process. It’s quite a foundational role, actually.

How Does the Washoe County Assessor Figure Property Worth?

When the Washoe County Assessor sets out to figure out a property's worth, they don't just pull a number from thin air. They follow a very specific process, which is that, pretty standardized across the country. It starts with looking at what similar properties have sold for in the area. This is often called the sales comparison approach, and it’s a key piece of the puzzle.

They also consider the features of a particular property. Things like the size of the land, the square footage of the building, the number of bedrooms and bathrooms, and even the age of the structure all play a part. The condition of the property matters, too, as does any major improvements or additions that have been made. These details help paint a more complete picture of its value, you see.

For some types of properties, like commercial buildings, the Washoe County Assessor might also look at how much income a property could bring in. This is known as the income approach, and it’s used when the property is primarily for making money, like an apartment complex or an office building. It’s a different way to think about worth, based on its earning potential, so.

Then there's the cost approach, which considers how much it would cost to build a similar property today, minus any wear and tear. This method is often used for newer properties or ones that don't have a lot of recent sales to compare to. All these different ways of looking at worth come together to help the Washoe County Assessor arrive at a fair valuation, which is that, their main goal.

They also consider things like zoning, access to roads, and even the presence of utilities. All these factors can influence how a property is used and, therefore, its worth. It’s a comprehensive look, really, aimed at getting the most accurate figure possible for tax purposes, more or less.

Why Do Property Values Change with the Washoe County Assessor?

It’s a common question, why does my property value go up or down? Well, the Washoe County Assessor’s figures for property worth are not set in stone; they can shift over time. One of the biggest reasons for change is the overall real estate market. If a lot of people want to buy homes in Washoe County, and there aren’t many available, prices tend to go up. This market demand can definitely push assessed values higher, too.

Another factor is improvements you might make to your property. Adding a new room, putting in a fancy kitchen, or even building a detached garage can increase its overall worth. When the Washoe County Assessor learns about these changes, they will update the property's value to reflect the added features. It’s about recognizing the extra investment you’ve put in, you know.

Economic conditions also play a part. When the economy is doing well, people have more money, and property values often rise. If there's an economic downturn, though, values might soften or even drop. The Washoe County Assessor keeps an eye on these larger trends to make sure their valuations stay current with the economic climate, so.

Sometimes, changes in local amenities or infrastructure can affect values. If a new park opens nearby, or a major road project makes commuting easier, properties in that area might become more desirable, pushing their worth up. Conversely, if something negative happens, like a new noise source, values could potentially go down. It’s all about how attractive the area is, in a way.

The Washoe County Assessor also performs regular revaluations, which is that, a process where they look at all properties in the county again, typically every few years. This helps them keep up with all these changes and ensure that values are fair and reflect current market conditions. It’s not a constant adjustment, but a periodic review to keep things balanced, pretty much.

Can You Talk to the Washoe County Assessor About Your Property?

Absolutely, you can indeed talk to the Washoe County Assessor’s office about your property’s worth. If you get your assessment notice and you think there might be a mistake, or if you just have questions about how they arrived at their figure, reaching out is the first step. They are there to help explain things and address concerns, you know.

Often, the process starts with an informal review. This means you can call or visit the Washoe County Assessor’s office and talk directly with someone about your property. You might provide them with information you think they missed, or point out features of your property that might affect its worth differently than they assessed. It’s a good way to clear up misunderstandings without a lot of fuss, really.

If an informal chat doesn't resolve your concerns, there’s usually a more formal appeal process available. This involves filing a specific form and often presenting your case to a review board. You would need to provide evidence to support your claim that the assessment is incorrect, like recent sales of very similar properties that sold for less, or proof of a significant issue with your property. The Washoe County Assessor's website will have details on how to start this, pretty much.

It’s important to remember that there are deadlines for these appeals. You can’t just decide to appeal months after you receive your notice. So, when that assessment notice arrives, it’s a good idea to look it over right away and decide if you have questions or concerns. Acting promptly helps you keep your options open with the Washoe County Assessor, so.

They want to get it right, too. The Washoe County Assessor aims for fair and accurate valuations, and sometimes, property owners have information that can help them achieve that. So, don't hesitate to reach out if you have a valid question or a piece of information that could change their view, you know.

What Services Does the Washoe County Assessor Offer?

Beyond just putting a value on properties, the Washoe County Assessor’s office offers a range of other services that are quite helpful for the public. One key service is providing public access to property records. This means you can look up details about almost any piece of land or building in the county, including ownership history, assessed values, and sometimes even building permits. It’s a good resource for researchers, real estate professionals, and just curious citizens, too.

They also maintain detailed maps of the county’s parcels. These maps show property lines, lot sizes, and other geographical information. This mapping data is a really valuable tool for planning, development, and simply understanding the layout of our communities. The Washoe County Assessor’s maps are often available online, making them easy to access, you know.

Another important service relates to exemptions. Certain property owners might qualify for reductions in their assessed value, which can lower their property tax bill. This often applies to veterans, seniors, or those with disabilities. The Washoe County Assessor’s office can provide information on these exemptions and help eligible individuals apply for them. It’s a way to offer some relief to specific groups, in a way.

They also help with business personal property declarations. If you own a business, you might have equipment, furniture, or other items that are considered personal property and are taxable. The Washoe County Assessor helps businesses understand what needs to be declared and how those items are valued. It’s a different side of their work, but just as important for the local economy, so.

So, it’s clear that the Washoe County Assessor does a good deal more than just send out assessment notices. They are a hub of property information and support for a wide variety of needs within the county, really.

Making Sense of Your Property Tax Bill - A Look from the Washoe County Assessor's View

When you get your property tax bill, it can seem like a lot of numbers and figures, but the Washoe County Assessor’s work is the very first step in how that bill gets put together. Their assessment of your property’s worth is the foundation. It’s important to remember that the assessor doesn't decide how much tax you pay in dollars and cents, but rather what your property is worth for tax purposes, you know.

The actual tax amount is determined by tax rates set by various local taxing entities, like the county government, school districts, and special improvement districts. These rates are applied to your assessed value to figure out your total tax. So, while the Washoe County Assessor provides the "value" part, other bodies decide the "rate" part. It’s a team effort, in a way, to collect the funds needed for public services, so.

Understanding the difference between market value and assessed value is pretty important here. The Washoe County Assessor calculates an assessed value, which is often a percentage of the property’s full market value. This assessed value is what the tax rates are applied to. Market value, on the other hand, is what your property would likely sell for on the open market today. They are related, but not always the same figure, which is that, a common point of confusion.

Your tax bill will typically break down where your money is going. You’ll see amounts allocated to schools, to the county general fund, to fire protection, and so on. This shows how the money collected based on the Washoe County Assessor’s valuations gets distributed to support all those essential services in our community, pretty much.

If you have questions about your specific tax bill, while the Washoe County Assessor can explain the valuation part, you might need to contact the county treasurer or the specific taxing districts for details about the rates and the total amount due. It’s a good idea to know who to ask for which piece of information, too.

How the Washoe County Assessor Helps Our Community

The work of the Washoe County Assessor might seem like just a technical task, but it really plays a vital role in keeping our community running smoothly. By fairly and consistently valuing all properties, they help ensure that the burden of funding public services is shared equitably among property owners. This fairness is a pretty important principle for local government, you know.

Think about all the things that make Washoe County a good place to live: well-maintained roads, effective police and fire services, and good schools. All these rely on a steady stream of income, much of which comes from property taxes. The Washoe County Assessor’s accurate valuations are the very first step in making sure that income is there, so.

Without their diligent work, the system could become unbalanced, with some properties potentially paying too much and others too little. This could lead to arguments and a feeling of unfairness among residents. The Washoe County Assessor helps prevent that by providing a clear, consistent method for figuring out property worth, in a way.

They also provide valuable data that helps with planning for the future. Knowing the total value of property in the county, and how it’s changing, helps local leaders make informed decisions about budgets, infrastructure projects, and community development. It’s a foundation for growth and stability, too, for our area.

So, while you might not think about the Washoe County Assessor every day, their contribution to the collective well-being of our neighborhoods and public services is actually quite significant. They are a quiet but essential part of what makes our county function, pretty much.

Connecting with the Washoe County Assessor

If you have questions about your property, or just want to learn more about the work of the Washoe County Assessor, getting in touch is usually pretty straightforward. Their official website is often the best place to start. It typically has a lot of information, including frequently asked questions, forms for appeals, and contact details for different departments within the office, so.

You can usually find their physical address and phone number on the website as well. For specific questions about your property’s valuation, it’s often helpful to call them directly or even visit in person during business hours. Having your property’s address or parcel number handy will make the conversation go a lot smoother, you know.

They might also have email addresses for general inquiries or specific departments. This can be a good option if your question isn't urgent and you prefer to have a written record of your communication. The Washoe County Assessor aims to be accessible to the public, as their work impacts so many residents, pretty much.

Remember, when you contact them, be clear about your question or concern. Providing all the relevant details upfront helps them assist you more effectively. Whether it’s about a new assessment, an exemption, or just understanding a specific term, they are generally quite helpful in explaining their processes and findings. It’s good to connect when you have a question, actually.

In short, the Washoe County Assessor’s office is a key part of our local system, responsible for valuing properties fairly and providing important information to the public. Their work helps fund the services we all depend on, from schools to roads. Understanding their role and how to connect with them can help you stay informed about your own property and how it fits into the larger community picture. They are a resource for all property owners in the county, you know, and their door is open for questions.

Related Resources:

Detail Author:

- Name : Prof. Gennaro Abernathy

- Username : klocko.raven

- Email : jordy.hermann@nicolas.com

- Birthdate : 1999-12-21

- Address : 74641 Fritsch Vista Suite 499 Cullenmouth, WI 41112-3170

- Phone : +1-770-410-7211

- Company : Muller PLC

- Job : Budget Analyst

- Bio : Numquam hic est facere ullam ut et alias. Qui ut facilis in at saepe reiciendis. Nemo eos reiciendis at.

Socials

instagram:

- url : https://instagram.com/paltenwerth

- username : paltenwerth

- bio : Asperiores est ad et iure. Eius facilis cupiditate et quia animi.

- followers : 4310

- following : 2532

tiktok:

- url : https://tiktok.com/@altenwerth1978

- username : altenwerth1978

- bio : Sunt fugit esse occaecati. Et ut animi odit facere.

- followers : 4047

- following : 1323

twitter:

- url : https://twitter.com/presley.altenwerth

- username : presley.altenwerth

- bio : Aut nemo pariatur ipsam nam error. Iste et voluptatem ipsam perferendis ratione beatae voluptas. Qui enim doloremque velit. Vel qui incidunt consequuntur ea.

- followers : 5307

- following : 2058

linkedin:

- url : https://linkedin.com/in/paltenwerth

- username : paltenwerth

- bio : Molestiae ut nesciunt deserunt aut hic.

- followers : 6322

- following : 1592